Abed William Lulu of Melville New York a stockbroker formerly employed by Worden Capital Management LLC has been barred from associating with any Financial Industry Regulatory Authority (FINRA) member in any capacity based upon allegations that Lulu failed to provide information to FINRA that had been requested of him. Case No. 2017055568801 (May 7, 2018).

According to FINRA Public Disclosure, FINRA initially sent Lulu a Notice of Suspension letter on February 2, 2018 and a Suspension from Association Letter on February 26, 2018. The regulator reportedly warned Lulu that by May 6, 2018, if he did not request for the termination of his suspension, FINRA would automatically bar Lulu from the securities industry. Lulu reportedly failed to cooperate with FINRA’s request by the deadline imposed.

This is the third time that Lulu has been sanctioned by FINRA based on accusations of his misconduct. Specifically, prior to FINRA barring Lulu, on January 24, 2017, it revoked his securities registration for failing to pay a fine that FINRA imposed based on Lulu failing to make required regulatory disclosures. Letter of Acceptance Waiver and Consent No. 2014040347901. That followed another regulatory action by FINRA on August 6, 2013, in which Lulu was suspended for failing to comply with an arbitration award.

Moreover, FINRA Public Disclosure confirms that Lulu is referenced in four customer initiated investment related disputes pertaining to allegations of Lulu’s misconduct while employed with D.J. Cromwell Investments, Inc., Global Arena Capital, Laidlaw and Company (UK) Ltd., and Continental Broker Dealer Corp.

For example, a customer initiated investment related arbitration claim regarding Lulu’s conduct was resolved for $23,000.00 in damages supported by accusations that equity trades were effected in the customer’s account on an excessive basis and transactions were effected in the customer’s account that were not suitable for the customer. FINRA Arbitration No. 17-02227 (Oct. 17, 2017). Prior to that, on December 20, 2012, a customer filed an investment related complaint regarding Lulu’s conduct where the customer sought $6,000.00 in damages founded on allegations of unauthorized James River Coal and Arena Coal over-the-counter equities transactions being placed in the customer’s account.

Moreover, on January 28, 2014, a customer filed an investment related complaint involving Lulu’s activities in which the customer requested $35,000.00 in damages based upon accusations of excessive commissions being charged to the customer on securities transactions. And on July 16, 2001, a customer filed an investment related complaint concerning Lulu’s conduct in which the customer requested $29,000.00 in damages supported by allegations of misrepresentation and unsuitability of over-the-counter equities sold to the customer.

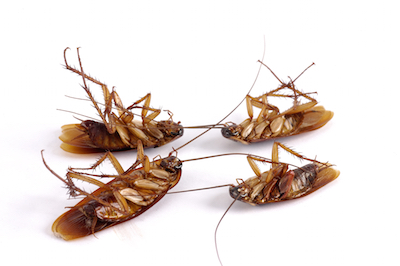

Lulu’s registration with Worden Capital Management LLC has been terminated as of August 18, 2016. Lulu has been associated with twenty three brokerage firms, twenty one of which have been expelled by securities regulators for violation of federal securities laws or are otherwise defunct. #cockroach

FINRA’S COCKROACH SQUAD TO REIN IN ROGUE BROKERS